The UK Life Sciences Ecosystem

Overview – about this project

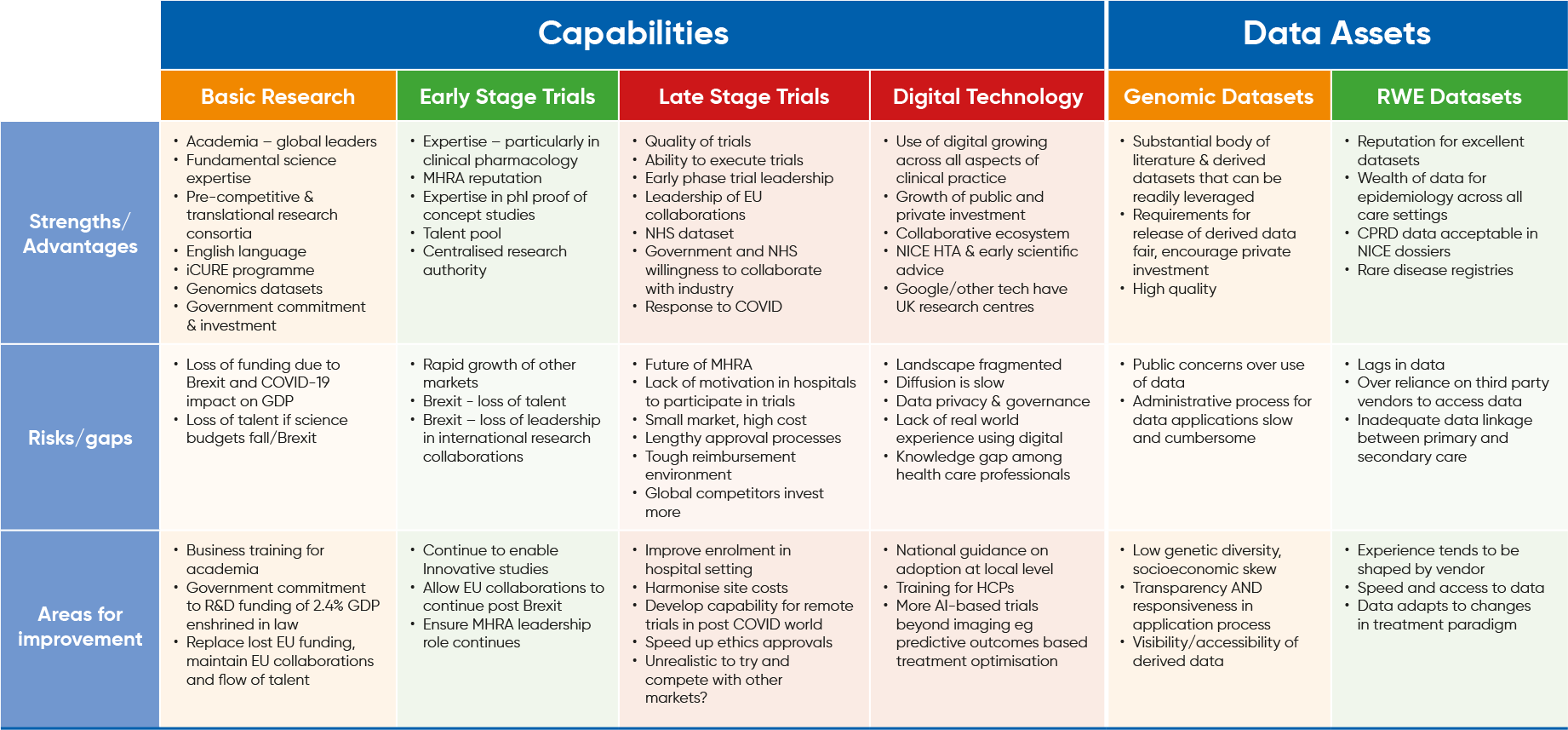

In 2020 JPG conducted an assessment of the strengths and weaknesses of the UK R&D ecosystem, as seen through the lens of colleagues working on R&D programmes in the UK.

This included consideration of improvements that would be valued and key competitor countries in different parts of what we consider to be the UK Value Chain.

In the course of this exercise we found there was a low awareness of the UK Life Sciences Strategy (now the Life Sciences Vision) in the Japanese R&D Community.

To address this JPG collaborated with the Office for Life Sciences and the Department for International Trade on a Global R&D Roundtable in February 2021, attended by global heads of research and development.

This was the first time that a group of Japanese R&D leaders came together in a meeting with the UK Government.

The meeting was hosted by Professor Sir John Bell and Lord James Bethell, Minister for Innovation. The group was joined by leading figures in UK research.

The goal was to showcase scientific and research excellence in the UK and address global HQ’s concerns that have resulted from EU exit.

The meeting also addressed future pandemic preparedness.

JPG view of the Life Sciences Ecosystem in the UK

Overall Project Conclusions

Global leader

Global Leader in Early Stage Trials

Key strengths

- The UK has a unique mix of leading scientific expertise, high quality facilities and an experienced regulator that means it is one of the best places in the world to run early stage trials*

- Collective nature of clinical pharmacology expertise in clinical units, academia and MHRA is a key differentiator

- MHRA accepts innovative study designs & local ethics committees are skilled in assessing pre-clinical data

- Phase I units have significant expertise in dose escalation, mass balance and proof of concept studies

- Centres of excellence in some disease areas

- Agile rapid manufacturing CMO/CROs

- Small biotech clusters around Golden Triangle are strong drivers of early trials

- UK Tax Regime is a key enabler for some JPG companies

Risks to global competitiveness

- Uncertainty about future alignment with EU regulations and research collaborations

- Complacency - MHRA expertise in phase I studies and early scientific advice must be safeguarded as other markets are improving their offer

Reinforcing actions

- Clarity and transparency on EU Exit future

- Building a system post Brexit that means leading investigators wish to remain in the UK.

- Enable continuity of EU collaborations

Key competitor countries

- China

Global leader in Real World Data

Strengths

- UK datasets have an excellent reputation and provide a wealth of data for epidemiology across all care settings with an ongoing drive to enhance quality and access

- CPRD

- Disease registries

- HES

- QoF

- Rare disease real world data

- NHS Digitrials

- CPRD data can support NICE dossiers and appraisals in other settings

- Commitments in LSIS to improve access and infrastructure

Risks/gaps

- Inadequate linkage between primary and secondary care

- Time lag in data availability

- Industry is over-reliant on third-party vendors

Reinforcing actions

- Ensure data collection aligns to changes in treatment paradigms.

- Improve speed and access to data

- Improve harmonisation of data

Key competitor countries

- Netherlands and Sweden

- Can vary according to disease area

Premier league

Premier League for Basic Science

Key strengths

- Academic excellence

- Leading universities and university hospitals

- Fundamental science, disease biology, genomics, medicinal chemistry

- Attracts top talent from around the world

- Collaboration sits at the heart of UK science

- Leadership of many significant EU collaborations,

- CASE-like research initiatives between academia and pharma sector

- ‘pay as you go’ approach to some collaborations favoured by pharma

- Pre-competitive research consortia

- Biomedical research clusters

- Translational consortia eg Dementia Platform UK

- JPG companies are working as part of a UK Dementia Consortium with Alzheimer’s Research UK

- Readily accessible funding streams from Government, research bodies and charitable institutions

- The UK Health Research Analysis 2018 published by UKCRC reports that a total of £2.56bn of research was funded by public bodies and charities in 2018, with the largest proportion (44%) coming from the charitable sector.

- The proactive role of Government incentivising research into antibiotics has seen increases in public and charitable sector funding in this area

Risks to global competitiveness

- Loss of IMI/Horizon 2020 funding & research collaborations following EU exit

- Some world class UK research sites are built on EU funding, leadership of EU collaborations which could now be at risk

- Perceived attitudes to immigration and potential exit of top talent EU nationals

Reinforcing actions

- Clarity and transparency on EU Exit future to instil confidence in the UK ecosystem

- Provide certainty for EU nationals already living in the UK

- Government must set out its long term strategy for research funding for academia and life sciences

- Learn from the success of the competition

- A business to business ‘culture’ underpins the US and Singaporean approach in academia and increases success in securing pharma investment. Provide training for UK universities on how to package their offers

- Enshrine the commitment to invest 2.4% of GDP in law as an Act of Parliament

Competitor countries

- USA (Boston), Singapore

Premier League in Genomics with World-leading Datasets

Key strengths

- UK Biobank and 500,000 Genomes have already been used extensively worldwide and UK research expertise has grown

- Researchers are developing fluency in these datasets

- Vetting process is rigorous and promotes high quality research

- Balanced approach to release of derived data encourages private investment and broad scientific utility

Risks/gaps

- Public concerns over use of data

- There is relatively low genetic diversity in the dataset

- Red tape means data applications are burdensome

Reinforcing actions

- Increase genetic and socioeconomic diversity

- Improve transparency and agility of the application process

- Increase accessibility of derived data

Competitor countries

- Not identified

Behind the curve

Despite a ‘head start’ the UK is behind the curve on late stage trials (JPG views are mixed)

Key strengths

- UK’s leadership of international collaborations, high proportion of early stage trials and global KOLs gives it a head start in trial placement

- Robust execution of trials

- A leading country for rare disease trials

- Response to COVID has demonstrated high potential

- Significant public sector investment in translational research system*

Risks/gaps

- Some JPG companies view the UK as a favoured location for investment in late stage trials but others believe the reality is that the global competition is too strong – others are investing more and recruit faster

- Absence of research culture in NHS

- High costs and slow set up times

- Small patient pool relative to other countries

- Future of MHRA is casting a shadow

- Multi-centre leadership shifting away due to Brexit

Remedial actions

- The system must continue to apply measures to help improve enrolment

- Address high costs – set up fees and wide variation in site budgets

- Speed up

- OLS and the NHS should enable the system to quickly adapt to remote trials in a post COVID world or risk slipping back further

- Turn the NHS dataset into a competitive opportunity as payers interest in RWE grows

Key competitor countries

- Russia, China, Eastern Europe

- UK leads in rare diseases

Green shoots but significant barriers to overcome in digital & AI

Strengths

- Determination in Government to be cutting edge and the system is organising itself accordingly

- Secretary of State is a champion of digital

- Evolving digital ecosystem at national level (NHSX, NHS Digital) and of incubation centres and tech transfer enabling commercialisation

- NICE is the only HTA body undertaking digital appraisals

- AHSNs are spearheading diffusion in partnership with industry

- Tech firms like Google are basing European Hubs in UK

- NHS is investing in skills through Digital Exemplars and wishes to be an early adopter in AI

- Investment in AI by public and private sectors is growing eg NHS investment in image ased technology in diagnosis and screening

Risks/gaps

- Diffusion is slow

- Poor NHS IT infrastructure

- Landscape is fragmented & CCGs are unwilling to engage

- Capability gap

- Data privacy and governance

Remedial actions

- Identify and learn from best practice

- Germany has a ‘national wrapper’ that has been effective in overcoming local barriers to adoption

- Digital is more advanced in some areas of clinical practice

- Ensure HTA guidance and pathways keep pace and appropriately updated

- Increase AI based trials beyond imaging into other areas of clinical practice eg treatment optimisation and personalised care

Competitor countries

- US leads globally

- Germany has the edge in Europe on digital

- China co-leads with US on AI